|

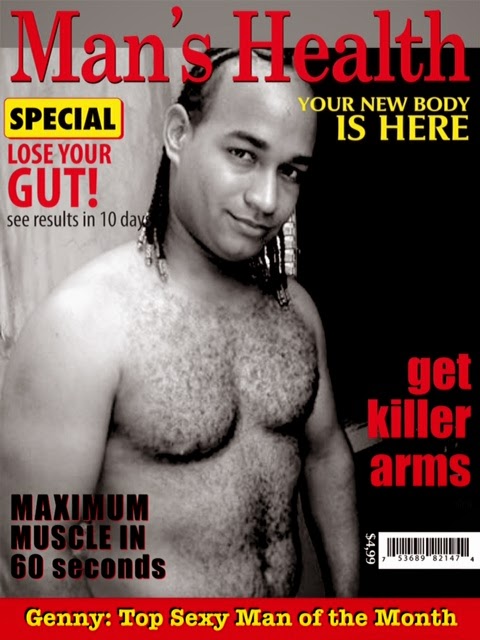

| JPMorgan Chase CEO Jamie Dimon, head of the largest bank in the U.S., arrives to testify on Capitol Hill in Washington, Wednesday, June 13, 2012, before the Senate Banking Committee, about how his company recently lost more than $2 billion on risky trades and whether its executives failed to properly manage those risks. |

WASHINGTON (AP) -- JPMorgan Chase CEO Jamie Dimon told Congress on Wednesday that senior bank executives responsible for a $2 billion trading loss will probably have some of their pay taken back by the company.

Under bank policy, stock grants and bonuses can be recovered from executives, even for exercising bad judgment, Dimon told the Senate Banking Commitee. The policy has never been invoked, he said, but he strongly suggested that it will be.

"It's likely that there will be clawbacks," he said.

Among the most likely candidates would be Ina Drew, JPMorgan's chief investment officer, who left the bank days after Dimon disclosed the loss on May 10. Drew oversaw the trading group responsible for the $2 billion loss.

Dimon, under close questioning from lawmakers about his own role in setting up the investment division responsible for the mess, declared: "We made a mistake. I'm absolutely responsible. The buck stops with me."

The trading loss has raised concerns that the biggest banks still pose risks to the U.S. financial system, less than four years after the financial crisis erupted in the fall of 2008.

Dimon's reputation for cost cutting and his perceived mastery of risk, particularly during the crisis, earned him respect in Washington. JPMorgan Chase & Co. weathered the crisis with relatively little damage.

At every turn before the committee, Dimon responded easily and in rapid-fire style to questions. He sounded notes of contrition - "We should have gotten it earlier" - but also defended the bank and his own criticism of some financial regulation.

Other than a few critical jabs from a couple of Democratic senators, the panel's treatment of Dimon was gentle compared to that received by other Wall Street executives in recent years on Capitol Hill.

Lloyd Blankfein, the CEO of Goldman Sachs, was roughed up at a hearing by a Senate investigative panel looking into allegations that the firm steered investors toward mortgage securities it knew would likely fail.

In December, former New Jersey Gov. Jon Corzine endured grueling questioning by three different committees over the collapse of the brokerage firm MF Global, which he had led as CEO.

Those grillings came after a parade of financial titans were derided and questioned by congressional committees conducting autopsies of the financial crisis for the TV cameras.

On Wednesday, Sen. Jim DeMint, R-S.C., told Dimon sympathetically that Congress manages to lose at least $2 billion every day. Referring to the bank, he said: "You appear to be in much better fiscal shape than we are as a country."

"The intent here is really not to sit in judgment," the senator said.

Far from crouching, Dimon appeared to strike a posture of a public advocate as the hearing ended. He urged Congress to act quickly to avoid the so-called fiscal cliff at the end of this year, when billions of dollars in tax cuts will expire and billions more in automatic government spending cuts will take effect.

"I think we'd better do something now, so we don't create additional uncertainty among businesses and consumers," Dimon said.

The start of the hearing was delayed by demonstrators in the room who shouted about stopping foreclosures. Another demonstrator shouted, "Jamie Dimon's a crook." At least a dozen people were escorted from the hearing room.

Dimon appeared serene during the outbursts, which lasted several minutes. At another point before the questioning began, he gave a broad smile.

The JPMorgan CEO contended that the trading loss, disclosed in a surprise conference call with reporters and banking analysts, was meant to hedge risk to the company and to protect it in case "things got really bad."

Two Democrats on the committee, Sens. Charles Schumer of New York and Robert Menendez of New Jersey, expressed concern about what would have happened if the trading loss had occurred at a weaker bank.

JPMorgan Chase is the largest bank in the United States by assets and is considered among the strongest. Dimon often makes note of the bank's "fortress balance sheet."

But Menendez hypothesized about a larger loss, perhaps $50 billion, that creates a run on the bank "and that ultimately becomes the collective responsibility of each and every American."

Menendez also challenged Dimon on his strenuous opposition to stricter financial regulation and noted that JPMorgan received a $20 billion taxpayer bailout loan at the depths of the 2008 crisis.

Dimon last September described as "anti-American" new international standards stipulating banks hold larger cash cushions to protect against losses, which U.S. regulators also have proposed for U.S. banks.

"You railed against us when we were in fact trying to pursue great capitalization of these banks," Menendez said. And he reminded Dimon scoldingly: "It seems to me that the American people are a big part of helping to make your bank healthy."

Dimon insisted that his bank "did not fight everything" and that there are elements of tougher financial regulation that he does support.

He skated a fine line in talking about his specific role in relation to the bank's trading operation. Asked whether he personally approved the investment office's trading strategy, Dimon said, "I was aware of it, but I didn't approve it."

Sen. Bob Corker, R-Tenn., who has received $10,000 since January 2011 from JPMorgan's political action committee, the most any candidate has received from the bank, praised Dimon as one of the "best CEOs in the country for financial institutions."

Still, he wondered: "You missed this. It's a blip on the radar screen. But are these institutions today just too complex to manage?"

Sixteen of the 22 members of the banking panel, including Chairman Sen. Tim Johnson, D-S.D., and senior Republican Sen. Richard Shelby of Alabama, have received money from the bank's political action committee, according to figures compiled by the Center for Responsive Politics.

JPMorgan Chase's stock price was flat at the start of trading, at 9:30 a.m., but began climbing steadily when the hearing began at 10 a.m. It finished the day up 1.6 percent, the second-best performer among the 30 stocks in the Dow Jones industrial average, after Johnson & Johnson.

The so-called Volcker rule, which goes into effect in July, will prevent banks from making certain trades for their own profit. Banks won an exemption to trade to protect their broad portfolios, as Dimon has said JPMorgan was doing in this case.

Dimon told the committee, however, that "I have a hard time distinguishing it." He allowed that "it's possible" that the Volcker rule would have prevented the debacle at JPMorgan but said he didn't know.

The CEO said that JPMorgan adopted a strategy late last year to reduce risk, but it backfired in its investment operation by heightening risk instead. The bank has named a new leader for the investment operation that was responsible for the loss.

A key regulator of JPMorgan, Thomas Curry, the U.S. comptroller of the currency, suggested last week that the bank lacked strong controls to contain risk in its investment operations.

And The Wall Street Journal reported Tuesday that some senior JPMorgan executives, including the chief financial officer and chief risk officer, were told about risky trading in London two years before the losses came to light.

Dimon himself knew of some of the trades and sometimes spoke with the traders involved, the Journal reported, citing unnamed people familiar with the matter.

The Securities and Exchange Commission is reviewing what JPMorgan told investors about its finances and the risks it took before the loss.

In April, in a conference call with analysts, Dimon dismissed concerns about the bank's trading as a "tempest in a teapot." Later, adopting a more conciliatory stance, he conceded that he'd been "dead wrong" to minimize those concerns.