|

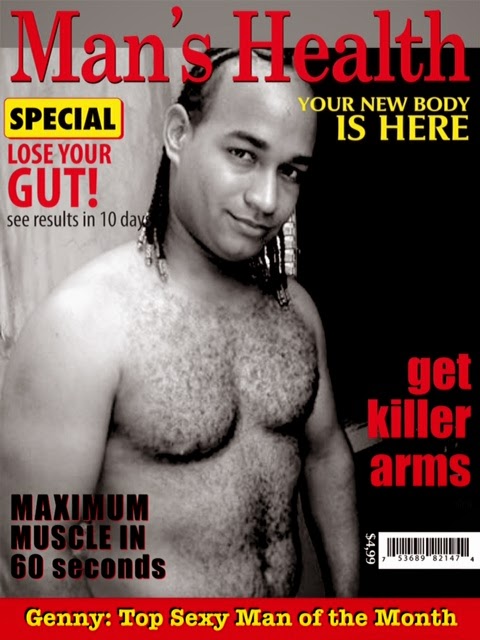

| In this Thursday, May 31, 2012, job seekers gather for employment opportunities at the 11th annual Skid Row Career Fair at the Los Angeles Mission in Los Angeles. U.S. employers created 69,000 jobs in May, the fewest in a year, and the unemployment rate ticked up. The dismal jobs figures could fan fears that the economy is sputtering. |

WASHINGTON (AP) -- The American economy is in trouble again.

Employers in the United States added only 69,000 jobs in May, the fewest in a year and not even close to what economists expected. For the first time since June, the unemployment rate rose, to 8.2 percent from 8.1 percent.

It was the third month in a row of weak job growth and further evidence that, just as in 2010 and 2011, a winter of hope for the economy has turned to a spring of disappointment.

"This is horrible," said Ian Shepherdson, chief economist at High Frequency Economics, a consulting firm.

The job figures, released Friday by the Labor Department, dealt a strong blow to President Barack Obama at the start of a general election campaign that will turn on the economy.

They also deepened the pessimism of investors, who even before the report was released were worried about a debt crisis in Europe with no sign of solution and signs of a slowdown in the powerhouse economy of China.

The Dow Jones industrial average fell 275 points, its worst day of the year, and for the first time was down for 2012. The Standard & Poor's 500 index is almost 10 percent below its 2012 high, the traditional definition of a market correction.

Mitt Romney, who on Tuesday cleared the number of convention delegates required to win the Republican presidential nomination, told CNBC that the report was "devastating."

He called for an emphasis on energy development, pledged to "kill" the health care overhaul that Obama saw through in 2010 and said he would reduce taxes and government spending. The clearest fix for the economy, he said, was to defeat Obama.

"It is now clear to everyone that President Obama's policies have failed to achieve their goals and that the Obama economy is crushing America's middle class," said Romney, the former Massachusetts governor.

Obama, in Minnesota, pushed a proposal to expand job opportunities for veterans returning from Iraq and Afghanistan. He said that the economy is not creating jobs "as fast as we want" but vowed that it would improve.

"We will come back stronger," he said. "We do have better days ahead."

Alan Krueger, head of the president's Council of Economic Advisers, pointed out that the country has added jobs for 27 months in a row, including 4.3 million jobs in the private sector.

Underscoring the challenge for Obama with five months to go in the campaign, a May poll by The Associated Press and GfK, a research company, showed that 52 percent disapproved of Obama's handling of the economy while 46 percent approved.

Some financial analysts said that the dismal job figures put pressure on the Federal Reserve to take additional steps to help the economy, but it was not clear how much good the Fed could do beyond trying to inspire confidence.

The central bank has already kept the short-term interest rate it controls at a record low of almost zero since the fall of 2008, during the financial crisis, and pledged to keep it there through late 2014.

It has undertaken two rounds of massive purchases of government bonds, starting in March 2009 and November 2010, to help drive long-term interest rates down and stimulate stock prices. Another program to lower long-term interest rates, known as Operation Twist, was announced last September and ends in June.

But low interest rates, other analysts pointed out, are not the problem. An investor stampede into bonds on Friday drove the yield on the 10-year U.S. Treasury note as low as 1.44 percent, the lowest on record.

Fed Chairman Ben Bernanke testifies next week before a joint committee of Congress, and the Fed next meets June 19 and 20.

Complicating the challenge for the economy, tax cuts passed under President George W. Bush will expire after Dec. 31, as will a cut in the Social Security payroll tax. More than $100 billion in automatic spending cuts to defense and domestic programs also kick in Jan. 1. Less money in consumers' pockets next year and less spending by the government would be a significant drag on the economy.

Congress could extend the tax cuts, but Republicans control the House of Representatives, and they have little political incentive to help Obama in the November election by doing so.

The Congressional Budget Office has said the tax increases and spending cuts would cause the economy to shrink at an annual rate of 1.3 percent in the first half of next year. The economy grew at a 1.9 percent annual rate in the first quarter of this year.

And there is little significant action that the White House can take on its own.

The job figures in the United States added to evidence that the world economy is in peril again.

Spain insisted Friday that it is financially stable, but its borrowing costs are creeping close to the 7 percent level that forced Greece, Ireland and Portugal to seek international bailouts.

Europe has grappled for more than two years with the crippling debt owed by many of its countries, and leaders remain divided over how to solve it. Stronger countries like Germany have insisted on government spending cuts, but voters in weaker countries are in no mood for further fiscal pain. Unemployment in the 17 countries that use the euro countries is a record 11 percent.

And even fast-growing economies in the developing world appear to be slowing.

India reported Thursday that its economy grew just 5.3 percent in the January-March quarter, slowest in nine years. And manufacturing in China, the world's second-largest economy after the United States and one of the fastest-growing, barely grew in May.

The U.S. government uses a survey of mostly large businesses and government agencies to determine how many jobs are added or lost each month. That is the survey that produced the 69,000 number.

It uses a separate survey of American households to calculate the unemployment rate. That survey picks up hiring by companies of all sizes, including small businesses, companies being started, farm workers and the self-employed.

The household survey found that 422,000 more Americans had jobs in May than in April. But the work force grew by 642,000 as more Americans who hadn't been looking for work started to look. That is why the unemployment rate inched up from 8.1 percent to 8.2 percent.

The economy lost 28,000 construction jobs, the worst for that industry in two years, and 13,000 government jobs. A category of employers called "leisure and hospitality" cut almost 9,000, mostly at amusement parks, museums and casinos.

And March and April, already disappointing months for job creation, were not as strong as first thought. The government revised the job-growth totals lower by 11,000 to 143,000 for March and by 38,000 to 77,000 for April.

From December through February, the economy added an average 252,000 jobs per month.

"There is virtually nothing positive in this report if you are trying to build a case for an economy that is supposed to be in recovery mode and gaining momentum," said Tom Porcelli, chief U.S. economist for RBC Capital Markets.

Investors made their disappointment clear.

The Dow, the S&P 500 and the Nasdaq composite index all fell by more than 2 percent. The S&P, which was up 12 percent for the year through March, was left with a slender gain of 1.6 percent.

Homebuilder stocks fell the most, apparently because the dismal picture for the U.S. economy outweighed a report that construction spending rose for a second month in April.

The price of gold, which some investors have often bought over the past three years for safety in turbulent economic times, climbed $58 an ounce, to $1,622, the highest since early May.

Anticipating weaker world demand, investors drove down the price of oil by $3.49 a barrel to $83.04, the lowest since October and 24 percent below its peak of $109.77 in February.

That will at least provide help for American drivers: The price of gasoline, which peaked at an average of $3.94 a gallon in April, has fallen to $3.61. It is below $3 in parts of South Carolina, and the national average should be below $3.50 soon.

Business owners cited a range of reasons for pulling back on hiring in May. Some said sales had been hurt by the weak economy in Europe. Others, like a California road construction company, said slower government spending was costing them.

But in interviews on Friday, most expressed general uncertainty about the U.S. economy.

Alan Gaynor's architectural design firm in New York, Alan Gaynor & Co., isn't hiring because his clients, real estate developers, are uneasy about starting projects.

"It's a wait-and-see attitude they have. Everyone's a little nervous. The economy's growing a lot slower than anyone would have liked," said Gaynor, who has 15 employees, the same as a year ago.

Still other businesses cited tight credit, a vestige of the 2008 financial crisis.

Robert Stewart Inc., a 93-year-old New Jersey company that makes neckties, wants to add five or six workers to its staff of 18, and business is up, said Steven Wishnew, the company's operations director.

But the company can't get the $50,000 to $100,000 in credit that would "kick-start our engine," he said, and sellers that used to give them 90 days to pay now demand payment in advance.

The bank wants the company's owners to put up their homes as collateral for a loan or line of credit, he said.

"You have to be insane to do that," Wishnew said. "Who knows where this economy is going?"