|

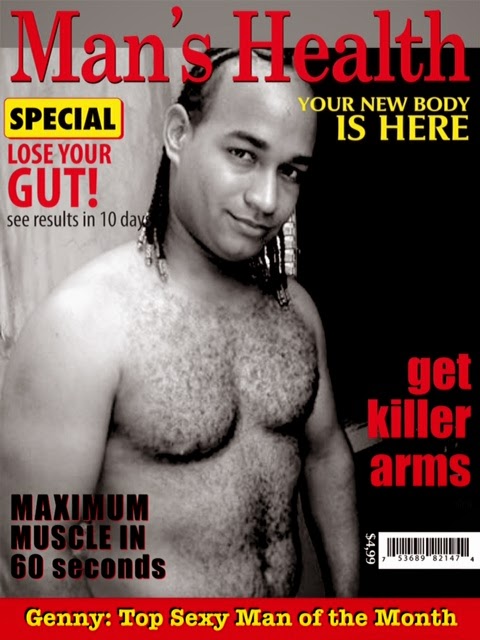

| Wall street broker William F. Lawrence looks at a monitor as he works on the trading floor of New York Stock Exchange shortly after the market opened Tuesday, Oct. 28, 2008 |

Wall Street's best day in two weeks - and one of its best ever - brought little real reason to celebrate. Even the manic, final-hour of buying that sent the Dow Jones industrials soaring almost 900 points Tuesday was overshadowed by the reality that it could turn on investors in an instant. The extraordinary, lurching volatility that has gripped Wall Street since the financial meltdown began in mid-September meant there were no guarantees the rally would hold, not even for a few days.

Investors are expecting a cut in interest rates when the Federal Reserve announces its decision Wednesday. But they're also staring into an economic abyss, bracing for a recession of a depth no one knows for sure.

Any other day like this - the Dow and the Standard and Poor's 500 both rose almost 11 percent - might have ended with boisterous cheers and paper tossed into the air. On Tuesday, 4 p.m. came with meager applause.

"I don't think it will be a sustained move," said Matt King, chief investment officer at Bell Investment Advisors.

The Dow finished 889 points higher to close at 9,065. On Oct. 13, the Dow rose 936 points, its best ever; no other single-day rally has come close in terms of points to what happened Tuesday.

Analysts ventured a number of explanations for the sudden rally - including coming interest rate cuts, bargain hunting, a market desperate to find a bottom and the expectation that banks, at the urging of the White House, will quit hoarding money and start making loans.

"There is nothing fundamental that came out today or yesterday that would take it up or down. We're all groping for something meaningful to talk about," said Bob Andres, chief investment strategist at Portfolio Management Consultants. "The market is exhausted from going down."

The mood on Main Street is decidedly more pessimistic, and new data Tuesday showed Americans are more depressed than market analysts had expected.

The Conference Board's consumer confidence index plunged to the lowest level in its 41-year history in the wake of this month's financial meltdown, the sharp drop in home prices and increasing job losses.

The index fell to 38, down from a September reading of about 61 - the third-steepest monthly decline since the board started the measure in 1967. Analysts, way off the mark, had expected 52.

"It's the worst consumer environment since the 1981-1982 recession," said Adam York, an economist at Wachovia Corp. Americans believe "there's a very dire situation in the U.S. economy right now, and they're not far from being right," he added.

Financial market turmoil and falling housing prices have wiped out trillions of dollars of household wealth in recent months. The S&P 500 had fallen 27 percent in October, and 40 percent for the year, before Tuesday's jump.

In addition, companies cut 760,000 jobs in the first nine months this year, sending the unemployment rate to 6.1 percent last month. Many economists expect layoffs to continue and the unemployment rate to rise to 8 percent or higher in 2009.

After the last recession, in 2001, the unemployment rate rose as high as 6.3 percent in June 2003.

On Tuesday, Whirlpool Corp. said it will cut 5,000 jobs. That's on top of other recent layoffs of thousands of workers by Xerox Corp., drugmaker Merck & Co. Inc. and financial services firm National City Corp.

"The collapse in confidence is directly tied to perceptions about economic conditions and that is likely to mean that households will keep their wallets closed," said Joel Naroff, an economist with Naroff Economic Advisors.

If they do, it'll happen at a bad time. The holiday season is just weeks away, and it's expected to be anemic.

"I don't know how long this is going to last," said Johnny Hunt, 50, a carpenter in Deltona, Fla., who says he is cutting back on a lot of things. "So I got to save money. You've got to hold onto what you do have."

S&P said in a report earlier this week that holiday retail sales would probably fall 2 percent to $250 billion this year, "the most difficult holiday season in memory for U.S. retailers."

Holiday sales have increased an average of 4.4 percent a year in the past decade, the report said.

Meanwhile, the housing slump, which set off the mortgage crisis that has consumed Wall Street for more than a year, shows no sign of abating. A closely watched index of home prices fell Tuesday by its steepest ever annual rate in August.

The Standard & Poor's/Case-Shiller 20-city housing index dropped a record 16.6 percent from August last year, the largest drop since its inception in 2000.

In addition, the Census Bureau reported that 2.8 percent of U.S. homes - excluding rental properties - were vacant and for sale in the third quarter, unchanged from the second quarter. That works out to 2.22 million properties, the second-highest quarterly number in records going back to 1956.

The first quarter clocked in at a 2.9 percent vacancy rate. In a normal market, it's about 1.7 percent, said Patrick Newport, an economist at IHS Global Insight. That means there's more than 800,000 excess vacant homes on the market.

Exacerbating the pricing environment is a rash of foreclosures, especially in once-hot markets like California, Las Vegas, Florida and Phoenix. Home prices are falling fastest there, according to Case-Shiller - dropping as much as 30 percent in August.

To move foreclosed properties off their books, lenders are sharply discounting prices, which is weighing down median prices.

On Thursday, the Commerce Department will provide its first estimate of the economy's third quarter performance, and many economists think the economy shrank. Economic contraction for the third and fourth quarters consecutively would meet the classic definition of recession.